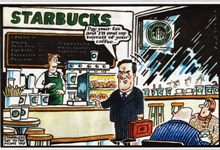

Corporate public relations executives for the likes of Starbucks, Amazon and Google are waiting anxiously to discover what fresh humiliation might be in store in the backlash which has followed the revelations about off-shore schemes used to limit their liability to UK corporation tax.

Corporate public relations executives for the likes of Starbucks, Amazon and Google are waiting anxiously to discover what fresh humiliation might be in store in the backlash which has followed the revelations about off-shore schemes used to limit their liability to UK corporation tax.

Ever since top directors suffered the indignity last November of being pilloried as tax avoiders at a hearing of the House of Commons Public Accounts Committee, the tax affairs of leading US multi-nationals have become a hot topic for debate.

An indication of the government’s course of action is unlikely before the Chancellor of the Exchequer George Osborne delivers his Budget next month (20.3.2013) but MPs have the ability to sustain their assault rather than rest of their laurels.

A chance encounter with Margaret Hodge, the fiery chairman of the House of Commons Public Accounts Committee, did not suggest the corporate pr world has much to be concerned about. To my surprise she seemed to be indicating that the committee had adopted a wait-and-see position rather than keeping up the momentum by recalling the directors for another parliamentary grilling.

Starbucks was undoubtedly the hardest hit after last November’s hearing. Within days – amid signs of a damaging customer boycott of Starbucks coffee shops – the company announced a swift about turn. Full-page advertisements in national newspapers in early December announced that Starbucks was “taking action to pay corporation tax in the United Kingdom – above what is currently required by law.” Reports suggested Starbucks could offer up to £20 million to the Treasury.

Starbucks was undoubtedly the hardest hit after last November’s hearing. Within days – amid signs of a damaging customer boycott of Starbucks coffee shops – the company announced a swift about turn. Full-page advertisements in national newspapers in early December announced that Starbucks was “taking action to pay corporation tax in the United Kingdom – above what is currently required by law.” Reports suggested Starbucks could offer up to £20 million to the Treasury.

But there has been no sign of any re-think by either Amazon or Google. Indeed Google’s chairman Eric Schmidt went as far as to suggest that the company was “very proud” of its tax-avoidance strategy: Google paid taxes “in the legally prescribed ways...based on the incentives governments offered us to operate.”

Given Starbucks’ U-turn and the intransigence of Google I would have thought there is every justification for their executives to be recalled by the Public Accounts Committee. On meeting Margaret Hodge at the inaugural Paddy Power and Total Politics Political Book Awards (7.2.2013) I immediately congratulated her on the sterling work being done by her committee.

I said that I thought the country was with her; there was a tsunami in British High Streets due in no small part to the unaccountable power of multi-nationals such as Amazon and Starbucks and I said I hoped she would call the directors back for a follow-up cross examination. I found her response disappointing:

“The trouble with calling them back is that this time they would be well prepared. We caught them out last time because they weren’t prepared. So we have banked that and we are thinking about what to do next.”

My heart sank: after many years’ experience reporting the work of the House of Commons select committees I knew that Margaret Hodge’s answer was yet further confirmation of the woeful under-funding of the Westminster select committee system. Compared with US congressional committees, the select committees have minimal resources.

Here was a classic illustration of their inability to follow through. Of course executives of Starbucks, Amazon and Google would be well prepared if they were re-examined by MPs but so should the members of the Public Accounts Committee.

There have been material changes since the November hearing – such as Starbucks’ U-turn and Google’s provocative stance – and the committee should not let go. Why not call in John Lewis and other British companies which are unfairly penalised by Amazon’s tax-avoidance structures.

My parting shot to Margaret Hodge was that her committee should keep it up. The British public wanted to see US multi-nationals held to account and her committee was the only authoritative forum which had the ability to deliver a powerful punch. My worry is that image reputation consultants in the well-paid world of corporate public relations have nothing much to fear.

Illustrations: I (22.11.2012), Daily Express (4.12.2012)

END